ACCRUAL ACCOUNTING

()

Business Management

The process by which an individual determines direction, influences a group, and directs the group toward a specific goal or mission.

The process by which an individual determines direction, influences a group, and directs the group toward a specific goal or mission.

Course Description

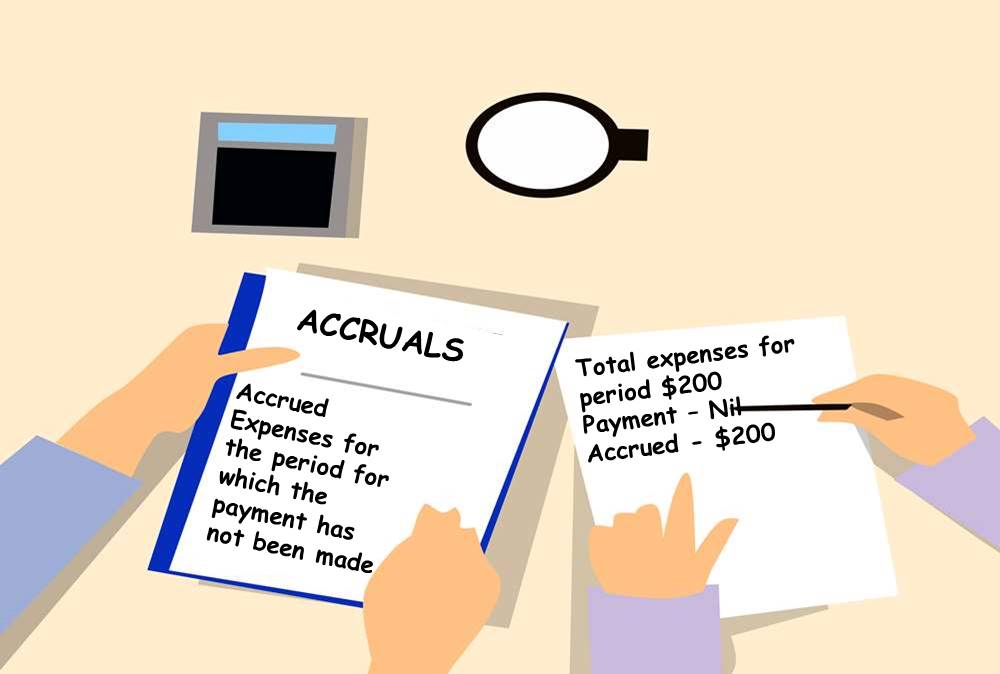

In financial accounting or accrual accounting, accruals refer to the recording of revenues

that a company has earned but has yet to receive payment for, and the expenses that have been

incurred but that the company has yet to pay. In simple terms, it is the accounting adjustment of

accumulated debits and credits. Such accounting practices, therefore, have a general impact on

the handling of the income statement and the balance sheet. The affected accounts include

accounts payable, liabilities and non-cash-based assets, goodwill, future tax liabilities, and future

interest expenses, among others.

Learning Outcome

1. Define accrual accounting and how it is used to record business transaction.

2. Explain what an accrual is and illustrate how it works.

3. Compare how cash basis accounting differs from accrual accounting.

4. Explain how you affect the accrual process.

5. Discuss the importance of accrual accounting for financial reporting purposes.

Course Content

Contact us for a quote or in case of any urgent queries please send us an email on: [email protected]

we will get back to you right away!