Menu

Trainings Courses

Business Management

The course is the dynamic nature of today’s organizations means both rewards and challenges for individuals who will be managing those organization

Health & Safety

The course covers the fundamentals of working safely – focusing on the importance of individual responsibility in preventing workplace accidents. This introductory qualification is for those who needs to understand the principles of health and safety as part of their job.

Engineering and Technical

The course covers the fundamentals of working technical industry focusing on the importance of individual responsibility in learning technical aspects for workplace. This introductory qualification is for those who needs to understand the principles of technical industry as part of their job.

ICT, Clouds and Security

Our ICT Cloud and Security courses provide you with essential knowledge and hands-on skills to excel in the dynamic fields of cloud computing and cybersecurity, ensuring the resilience and security of digital ecosystems

Digital Transformation

Sensible integration of technology into business is the Digital transformation. It touches all aspects of human life and society from daily life utilities, education, jobs, managing financials, transportation, health-care, communication and approximately everything.

Cloud Adoption

Cloud Adoption is a strategic move by organizations of reducing cost, mitigating risk and achieving scalability of database capabilities. Cloud adoption may be up to various degrees in an organization, depending on the depth of adoption. Hence there is a need for compliance assessment during cloud adoption.

AI, Blockchain & IOT

As a leading artificial intelligence company, Orient MCT helps businesses in various industries achieve higher productivity and fuel business growth with automation, machine learning, smart recognition and more.

IT Governance, Risk & Compliance

GRC is a flagship practice at Orient MCT. Think of GRC as a structured approach to aligning IT with business objectives, while effectively managing enterprise risk and meeting compliance requirements.

Our Consulting Company offer innovative, pragmatic solutions for your business needs. Our approach revolves around flexibility, accountability and an expert service that allows you to concentrate on your core business.

OSHAD & Legal Compliance

OSHAD SF is a management tool that integrates Occupational Health and Safety management components of a business into one coherent system. The integration of these components allows the business to achieve its objectives efficiently by managing the impacts of various activities and minimizing workplace risks.

QHSE Management System

QHSE management system can help to improve the quality of processes and products, control environmental impact to promote sustainability and ensure the health and safety of workers. QHSE places an emphasis on incremental improvement, communication, and reducing occupational risks. QHSE aims at building health and safety arrangements that are compatible with all places of work.

Sustainability Services

Sustainability, the long-term viability of a community, set of social institutions, or societal practice. In general, sustainability is understood as a form of intergenerational ethics in which the environmental and economic actions taken by present persons do not diminish the opportunities of future persons to enjoy similar levels of wealth, utility, or welfare.

Business Continuity & Resilence

OSHAD SF is a management tool that integrates Occupational Health and Safety management components of a business into one coherent system. The integration of these components allows the business to achieve its objectives efficiently by managing the impacts of various activities and minimizing workplace risks.

Featured Recent Projects

The partnership produce transformational results

Abu Dhabi Data

We proudly became part of Abu Dhabi government data management initiative and developed the gateway website to access all data related initiatives such as: Open Data, Data Market Place, Geospatial Data etc

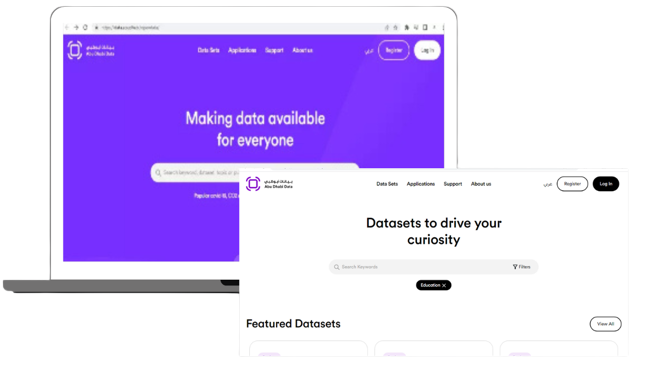

Abu Dhabi Open Data

Abu Dhabi Open Data Platform is revamped and managed by OrientMCT. It offers curated public data assets. enabling everyone to harness their value and wealth.

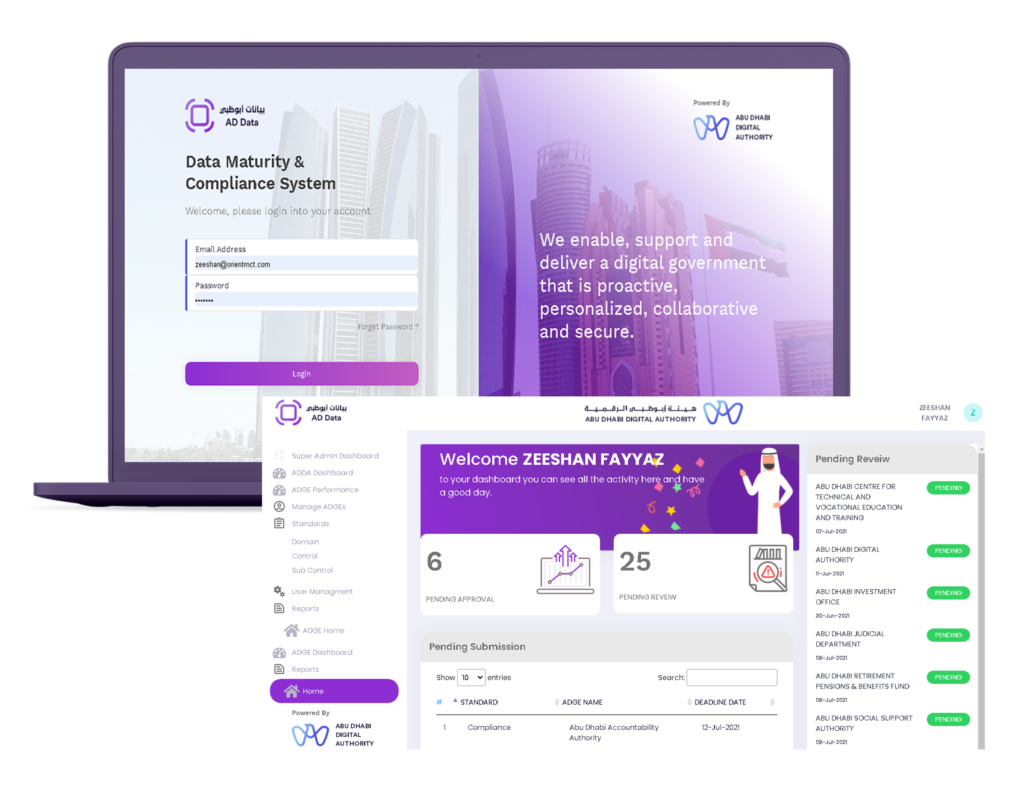

ADDA Data Maturity & Compliance System

We offer innovative, pragmatic solutions for your business needs. Our approach revolves around flexibility, accountability and an expert service that allows you to concentrate on your core business.

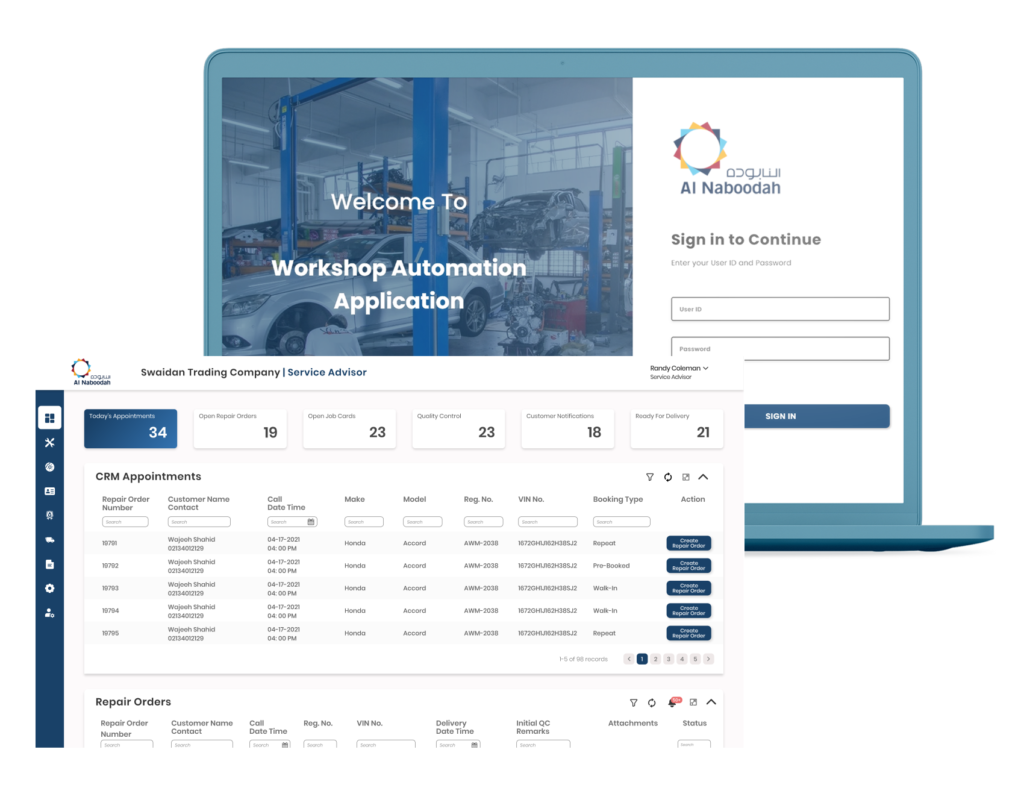

Al Naboodah Workshop Automation

Developing application for Al Naboodah Automobile division aims to digitize its services operation by providing state of the art application to its staff for improving productivity & efficiency

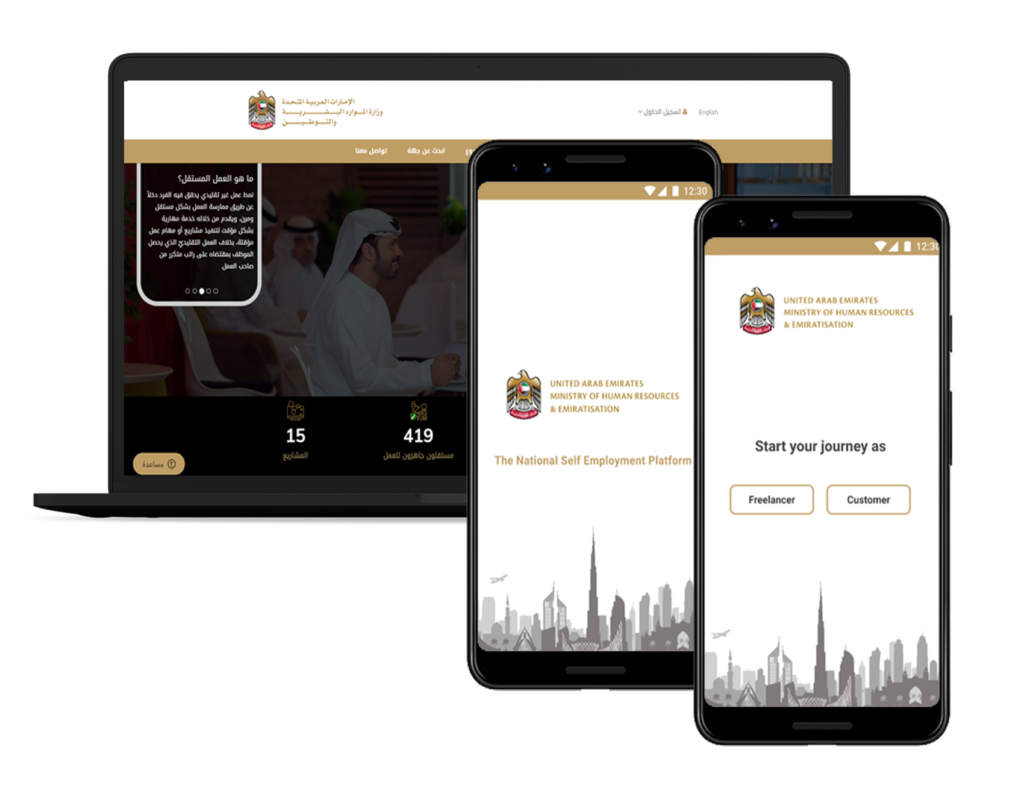

Freelancers Mobile App. for MOHRE & EF

National Self Employment Platform developed for Emirati youth to showcase their skills Online by Emirates Foundation & MOHRE

VSigns - Business Health Monitor

Diagnose your Business Health over 07 vital signs and 35 health markers to achieve success

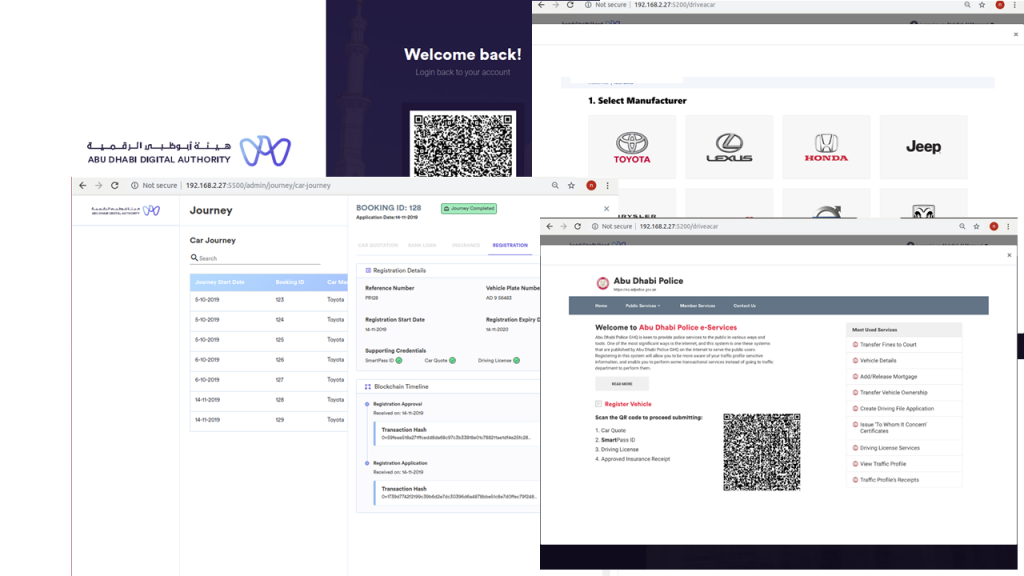

Blockchain Car Buying Journey

Developed Car buying journey POC on blockchain for ADDA (Abu Dhabi Digital Authority)

Awards Application for Dubai Immigration

Excellence Awards application for GDRFA (General Directorate of Residency & Foreigners Affairs) – Dubai

VSigns - Business Health Monitor

Diagnose your Business Health over 07 vital signs and 35 health markers to achieve success